While U.S. equities remain captivated by the AI boom, Europe’s market has taken a different path.

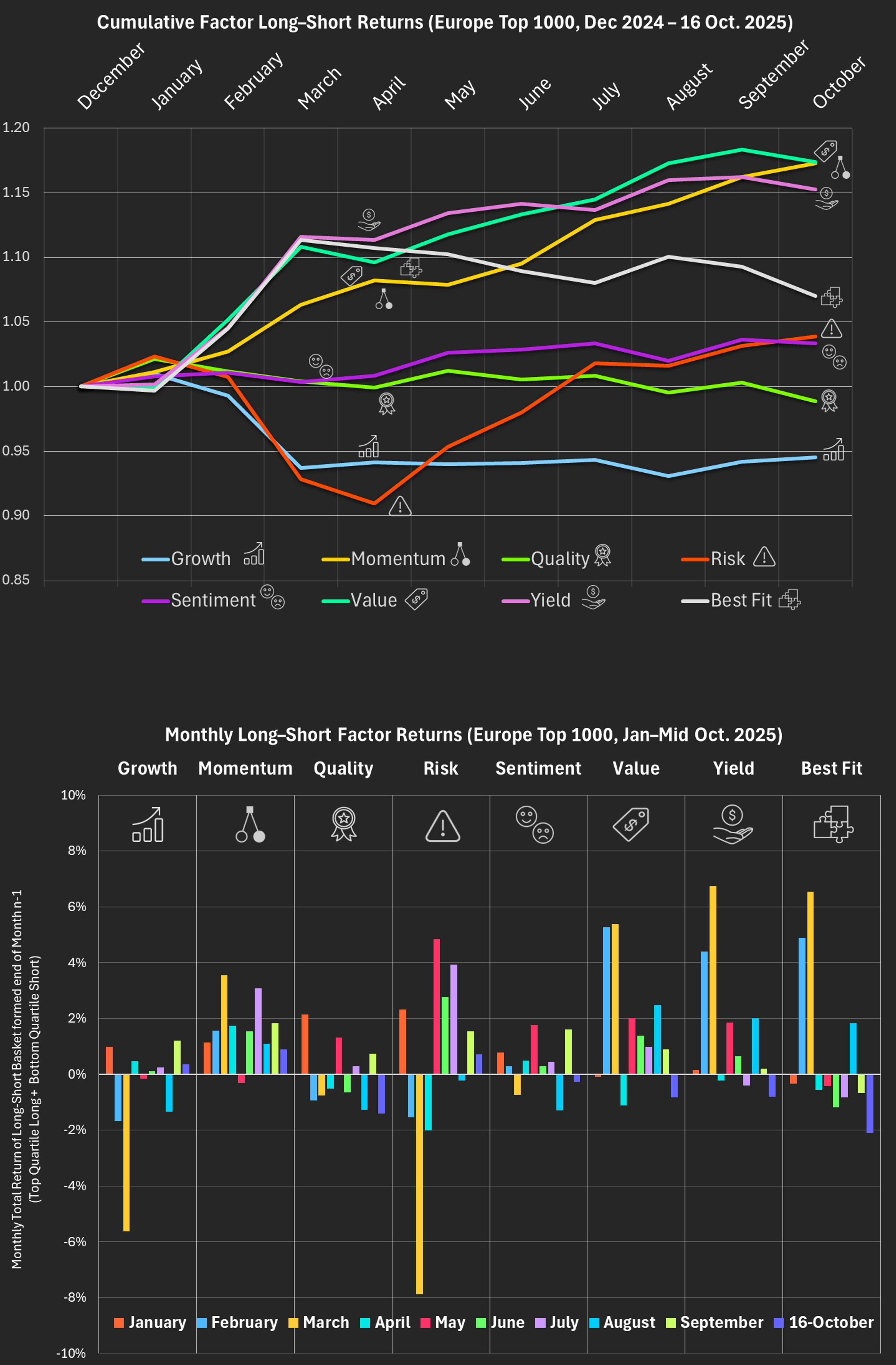

Our factor data show that 2025 continues the rise of cyclicals - a broad leadership from Value, Momentum and Yield styles, far from the tech-led frenzy across the Atlantic.

Both markets have performed well - but for completely different reasons.

Key patterns (Jan – mid-Oct 2025)

Sector backdrop

The factor rotation mirrors Europe’s market leadership:

These sectors - not AI giants - drove the outperformance of Value and Momentum. Cyclicals such as financials, energy and industrials powered the rally, while defensive growth sectors like Consumer & Household Products lagged. Europe’s market strength came from broad sector dispersion - many industries advancing together - rather than from the concentration of a few mega-caps as in the U.S.

Academic context

Classic research (Asness, Moskowitz & Pedersen, Value and Momentum Everywhere, 2013) finds that Value and Momentum usually move in opposite directions, acting as natural diversifiers.

In 2025, however, European markets show both factors performing strongly at the same time - a rare alignment that typically emerges during phases of rising dispersion and macro reacceleration. This supports later findings (Ilmanen et al., 2019/2021) that factor behaviour is state-dependent, evolving with market and economic conditions.

Europe vs U.S.

In our U.S. study - US Equity Factor Rotations in 2025: Risk-Off, Rebound and Real Drivers - Growth and Quality remained concentrated in a few AI-linked mega-caps.

Europe, by contrast, has rotated toward cyclicals, financials, and industrials, with no major AI winners - yet both regions delivered strong returns.

The disconnect is stunning.

Method: Europe top 1000 stocks. Baskets formed of long top-quartile and short bottom-quartile per factor, rebalanced monthly, total return.

.jpg)